Assume you are presented with two real estate deals, one with an IRR of 8% and the other with an IRR of 18%. Is it always true that a higher IRR deal is a better deal? Is IRR the only metric to be concerned about?

When it comes to turning a profit on investments, the simple trick is to know how to balance the risks against the potential rewards. Knowing how to calculate the Internal Rate of Return can gauge a ballpark figure on what kind of returns you can earn for a fixed period of time.

The Internal Rate of Return (IRR) works as an indicator tool for measuring the property’s long-term yield. It is a reliable and good concept for real estate investors to be familiar with.

This article will definitely give you an idea of what IRR stands for and how to estimate IRR for investments.

What exactly is the Internal Rate of Return (IRR)?

IRR can be defined as the discounted rate at which the Net Present Value (NPV) for a set of cash flows is equal to zero. In simple words, the IRR measures the investment’s annual return throughout the entire ownership of the property over the time frame. Inoperative, IRR can be understood as the percentage of interest investors earn on each rupee they have invested against the property over the holding period.

For example, if investors purchase a commercial building for the purpose of renting out and plan to accommodate the property for the next 10 years. They will earn interest on the rental income they receive during the first year for the rest of nine years. The income they receive in the second year will be the interest for the next eight years and so will go on with each new year it adds. And, finally, all the interest earned over the entire 10-years would be representing the IRR over the entire time.

How IRR Can Help Investors For Real Estate Investments?

In any type of investment opportunity, investors are not interested to know how much money they would receive potentially, indeed they are willing to know when they would be receiving with potentiality. Moreover, over the entire life of a real estate investment investors receive a series of interim payments from the tenants, as well as a large sum of money once the property is sold.

Occasionally there might include refinancing or some other event that can create additional sums of cash proceeds. As a result, the cash flows occurring over different months or years often do not bear relative value with equality. In such a case, IRR allows investors to compare the investment by proportionately weighting cash flows occurring at different times.

IRR is the key aid for the investors in the evaluation of investment opportunities as it equates fund flow over different periods to net present value. This concept holds that a rupee today is worth more than a rupee tomorrow due to its inflation, opportunity cost, and risk associated with it.

IRR can be a worthwhile concept for investment if done with due diligence. The few notable benefits of IRR includes:

What are the Benefits of IRR?

The IRR is useful because it allows for a “head-to-head” comparison of two cash flows with different distribution timing.

Time Value of Money

In IRR, the timing of all the future cash flows are taken into the record. As a result, each flow is given appropriate weight by discounting the time value of money.

Homogeneity

IRR is viewed as an easy and understandable metric to calculate and provides a simple way through which investors are able to compare various real estate projects.

Hurdle Rate Not Required

IRR doesn’t use ‘hurdle rate’ (i.e. the cost of capital, or the required rate of return at which the investors agree to fund the project) to mitigate the risk of determining the divergent rate. It can be calculated independently irrespective of such rates, and investors can compare their own individual estimated cost of capital to the IRR.

How to Calculate Internal Rate of Return (IRR)?

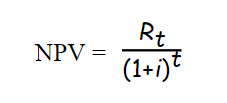

As a real estate investor, you should be knowing how to determine the internal rate of return and the steps associated with it. While there’s no specific equation for estimation of IRR, the formula is based on NPV ( Net Present Value) and sets it equal to zero in order to find the discount rate.

In order to calculate the IRR, investors need to understand the concept of discounting. It can be simply viewed as compounding interest in reverse way-i.e. Compounding interest working backward in time.

The discount rate is the value that IRR seeks. Thus, IRR can be calculated by equating the sum of the present values of future cash flows minus the initial investment to zero.

For the computation of NPV-

Where,

Rt = Net cash flow

t = Time of the cash flow

i = Discount rate

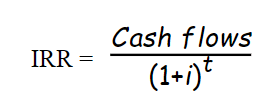

And the formulae of IRR –

Where,

Cash flows = Cash flows in the time period

i = Discount rate

t = Time period

To understand NPV and IRR calculations in-depth click here.

Keynotes While Evaluating IRR

Surely, IRR plays a significant role in indicating the performance of real estate investment. However, it does includes some shortfalls like:

Inadequate Comparison

IRR works especially for comparing investments of similar lengths, i.e. two single-family rentals you plan to hold for ten years each. It doesn’t work well when comparisons of investments are done with different time frames.

Big Presumptions

IRR is dependent on a number of unpredictable factors. Investors’ calculation of projects won’t take into account market fluctuations, debt and project costs, rental prices, etc. IRR is largely based on assumptions rather than facts.

Jolt Over The Long Period

Every investor is aware that their property includes contingencies like unexpected repairs and damage. These are inevitable parts of every real estate investor. Likewise, vacancy periods and slower rent receivable can also limit expected cash flows. But, IRR will be excluding all of these unknowns.

When you consider it, no investment calculator can predict the future and will always include unanticipated expenses. Yet, you can sum up that you’ve dived into housing markets formulae like IRR- along with ROI, Cap rate, which can help you to make an educated decision between various properties.

What Can Be Construed As A Good IRR?

What can be considered a good IRR is based on different assumptions investors approach to take into account. It varies among different judgments of investors and is probably based on whether the property is commercial or residential real estate. While many looks to exclude the single-digit percentage, others question that a high IRR could result from the overestimation of increasing rent and appreciation of assets.

When considering what a good IRR is, it’s critical to examine the prospective investment and recognise that an IRR isn’t always what it appears to be. For example, a project may have a high top-level IRR, but the net IRR to you as an investor is lower because the developer or sponsor deducts asset management fees before making distributions. An IRR, on the other hand, may be understated due to the industry standard of calculating investment returns on an annual basis, even when distributions are made monthly or quarterly.

One of the easiest ways to judge the Internal Rate of Return on investment is to figure out the required annual return or the cost of capital. This will include the combined cost of debt and equity and will set a good benchmark to weigh against IRR. In precise, investors are always in the hunt for such projects where returns are higher than the cost.

For example, you have rental properties to choose from- on calculating the IRR of House 1 comes 10% while House 2 comes 11%. However, your cost of capital is 10%, so you can opt for House 1 as it will give 0% profit.

Why isn’t a higher IRR always the goal?

It is commonly assumed that larger is better – a 15% IRR is more appealing than a 10% IRR. However, one of the drawbacks of using an IRR analysis alone is that it can be misleading. When comparing real estate investment opportunities, it is also important to consider how an investor achieves that IRR. While a higher IRR may appear attractive on the surface, investors should look deeper to see the terms and assumptions used to calculate the IRR, as well as the desire for operational distributions. As a result, when evaluating the merits of a particular real estate investment offering, investors frequently use IRR in conjunction with other metrics. In our next article, we’ll show how comparing the IRR to the average cash-on-cash return and the equity multiple can teach investors a lot about an investment in a short amount of time.

Closure Interpretation

Given the kinetics above, investors are encouraged to use IRR in hand-to-hand with other metrics. Applying IRR along other measures of return can definitely help the investors appraise not only real estate opportunities but pragmatically any investment offering.

Moreover, using Internal Rate of Return with other metrics can paint a much more accurate picture of how the investment is expected to perform over the time frame. The wind-up object would be that investors must have a better grasp of both the past and potential returns across the investing spectrum.

Internal Rate of Return FAQs:

What do you understand about the Internal Rate of Return?

IRR can be understood as the discounted rate at which the net present value (NPV) for a set of cash flows is equal to zero.

IRR is viewed as an easy and understandable metric to calculate and provides a simple way through which investors are able to compare various real estate projects.

What can be taken as a good IRR?

For the investors, a good IRR is where returns are higher than the cost of the project.

IRR works especially for comparing investments of similar lengths, i.e. two single-family rentals you plan to hold for ten years each. It doesn’t work well when comparisons of investments are done with different time frames.

Listen to the article

Listen to the article